MEEZA QSTP LLC (Public) (“MEEZA” & “the Company”) announced its financial results for the financial year 2023, the period during which the Company became public and listed on the Qatar Stock Exchange.

Financial Summary

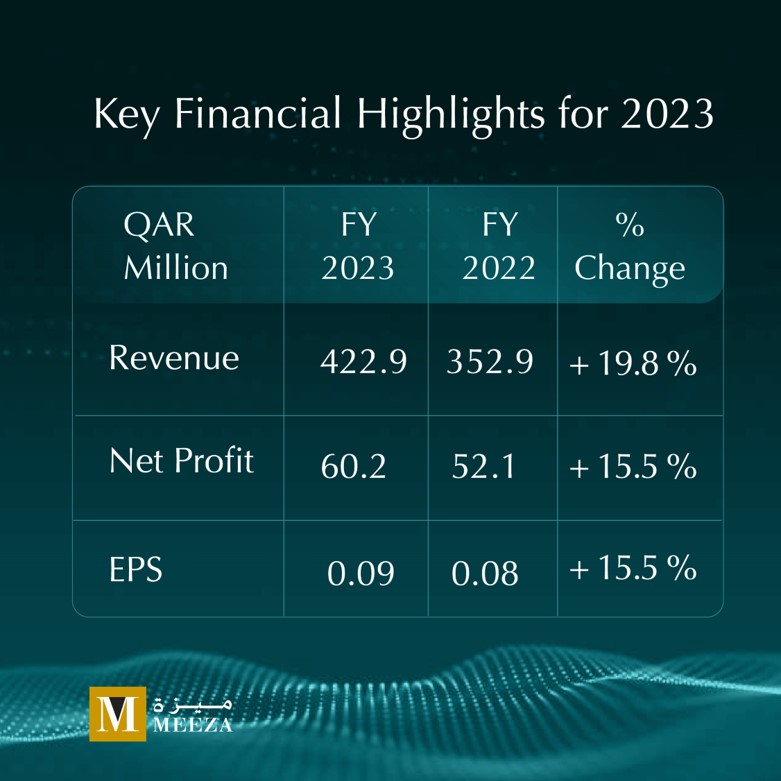

In the 12 months ended 31 December 2023, MEEZA’s Net Profit reached QR 60.2 million, representing a 15.5% (or QR 8.1 million) increase over the same period last year and the highest annual profit in the Company’s history, mainly driven by Revenue growth. Net Profit Margin for the period was 14.2%, with Earnings Per Share (EPS) of QR 0.09.

The Company’s Revenue grew by 19.8% (or QR 70.0 million) to reach QR 422.9 million, led by growth in the IT Solution Services and Managed Services segments. EBITDA for the year was QR 123.5 million, with an EBITDA margin of 29.2%

MEEZA boasts a healthy financial position with a cash balance of QR 250 million, in addition to QR 1.2 billion in future committed contract value.

Based on these results, the Board of Directors of MEEZA has proposed a cash dividend of QR 52.7 million (i.e QR 0.08 per share) subject to the approval of the Annual General Assembly.

During the year, the Company officially listed 100% of its shares on the Qatar Stock Exchange (ticker: MEZA) on 23 August 2023. The listing came after a successful IPO that was oversubscribed and involved the first ever book building exercise in the Qatar Stock Exchange’s history.

| QAR million | FY 2023 | FY 2022 | % change |

| Revenue | 422.9 | 352.9 | +19.8% |

| EBITDA* | 123.5 | 123.9 | -0.3% |

| Net Profit | 60.2 | 52.1 | +15.5% |

| EPS | 0.09 | 0.08** | +15.5% |

| *Earnings before Interest, Tax, Depreciation and Amortization

**Adjusted for the current number of shares |

|||

Commenting on MEEZA’s results, the Chairman of the Board of Directors, Sheikh Hamad Bin Abdulla Bin Jassim Al-Thani, said:

“2023 was a special year for MEEZA, undergoing a transformation into a public company and providing its unique investment case to a broad base of shareholders. We are pleased to announce MEEZA’s strong performance during the year, during which the Company recorded its highest net profit ever. We now have our eyes set on a period of expansion and growth to take advantage of the growth opportunities in the data center and managed IT services industries. MEEZA aims to maintain its leadership position and contribute to Qatar’s National Vision 2030 by diversifying the economy and leveraging the hydrocarbon sector to establish the country as a leading technology hub in the region.”

Mr. Mohsin Nasser Al-Ghaithani, MEEZA Acting CEO, added:

“It was a year full of achievements and successes in MEEZA’s journey to becoming the leading Data Center and Managed Services business in the Middle East and North Africa. The Company delivered strong growth in both its top line and bottom-line results. Operationally, we have maintained our stellar quality of service across our service portfolio in line with the leading industry standards. We have made significant strides in evolving our internal organization to meet the requirements from our growing operations and protect the interests of our shareholders through robust corporate governance. We are still on track to deliver the expansion plan detailed during our IPO phase and we look forward to make more announcements around that in 2024.”

Copyright © 2024 MEEZA, All Rights Reserved.